tax planning software for retirement

The best tax software in Canada helps you maximize your refund and many even allow you to file your taxes online for free. Browse online tax filing software from HR Block TurboTax Credit Karma Jackson Hewitt and more.

Smartdraw Retirement Planning And Tools At Kindur Kindur Retirement Planning How To Plan American Indian Quotes

And more to plan the best course of action for your clients tax investment and retirement planning.

. The good news. Tax software or a good tax advisor can help you figure out which deductions youre eligible for and whether they add up to more than the standard deduction. Overview of Michigan Retirement Tax Friendliness.

These are tax-free Roth or tax-deferred traditional accounts. As you can tell from the abundance of tax software commercials on television tax season is upon us once again. In Missouri income from retirement accounts such as an IRA or 401k is taxed as regular income though some exemptions are available.

By Sadie Ouillette Jun 2. Reducing tax liability and increasing the ability to make contributions towards retirement plans are critical for success. Software products are provided as a convenience to you and Fidelity bears no responsibility for your use of and output associated with such products.

To find a financial advisor who serves your area try our free online matching tool. Overall there are two major classes of retirement accounts. Find the definition and importance of Tax Planning here.

State Tax Analyzer with NOL Manager Increase accuracy and precision with the latest calculations and projections for corporate tax planning audits and cash tax management. This corporate tax audit and planning software automates and manages complex multi-year corporate income tax attributes such as carrybacks and carryovers. Get started Federal.

Software or age-old businesses everything today is ripe for disruption. More importantly Intuit Tax Advisor shows estimated tax savings for each of those recommended strategies. Tax Planning is a concept that helps you understand investments better.

If you can make extra payments on your highest-interest loan to reduce it faster. In retirement your income will likely be drawn from multiple sourcesand each source may have different tax withholding rules says Hayden Adams CPA CFP and director of tax planning at the Schwab Center for Financial Research. Direct Tax Software I-T e-TDS Audit Software for CAs Tax Professionals.

Missouri has combined state and local sales tax rates that are higher than the national average and property taxes that are below the national average. Overview of Missouri Retirement Tax Friendliness. Compare the best Tax Planning software of 2022 for your business.

Current information on your latest tax form and year to date activity updates. Retirement accounts come in many types. Learn how the tax planning you do today can help you save for years to come including preparing for tax day retirement and tax savvy giving strategies.

Homeowners pay relatively high property tax rates but sales taxes are moderate. Michigan does not tax Social Security retirement benefits and it provides deductions on all other types of retirement income. Depending on your situation you might not pay income taxes on the money you contribute to tax-deferred retirement accounts.

Intuit Tax Advisor provides customizable tax-saving strategies and insights in areas like retirement savings business expenses income and deduction timing higher education and shifting income between entities. Once you retire however tax planning can become more complicated. Planning for Retirement While Living With HIVAIDS.

Find the highest rated Tax Planning software pricing reviews free demos trials and more. Thomson Reuters Planner CS. View and download available tax forms including.

If you dont have a 401k or other employer-sponsored retirement plan consider opening a traditional or Roth IRA. Of these 326 used a tax software approved by the CRA for NETFILE 582 used an EFILE service and 02 of filers used File My Return. When you get extra money from a gift work bonus or tax refund use it to reduce your debt and save for retirement.

It supports W-2 income interest income dividend income retirement distributions the. A whopping 91 of Canadians who filed tax returns in 2021 did so by using electronic filling methods.

Best Retirement Planning Tools For 2022 Some Are Even Free

Partner Tpa Company Trpc Tpa Outsourcing Services Tpa Engine Small Business Accounting Software Accounting Career Happy Retirement Quotes

Brentmark Inc Financial Software

Early Retirement Distributions And Your Taxes Early Retirement Retirement Tax

Survival Tips Plants In 2021 Money Making Hacks Retirement Advice Money Makeover

Rethinking Retirement Planning With The New Tax Reform Bill Capital Gains Tax Accounting Business Tax

How To Vet Your Financial Planner Financial Planning Financial Planner Financial Literacy Lessons

Best Retirement Planning Tools For 2022 Some Are Even Free

Robot Check Retirement Planning Retirement Income How To Plan

Free Retirement Planning Spreadsheet What Is A Free Retirement Planning Spreadshee Budget Planner Worksheet Budget Worksheets Excel Business Plan Template Free

The Digital Finance Planner Goodnotes Optimized Pdf Etsy Finance Planner Retirement Planner Budget Planner

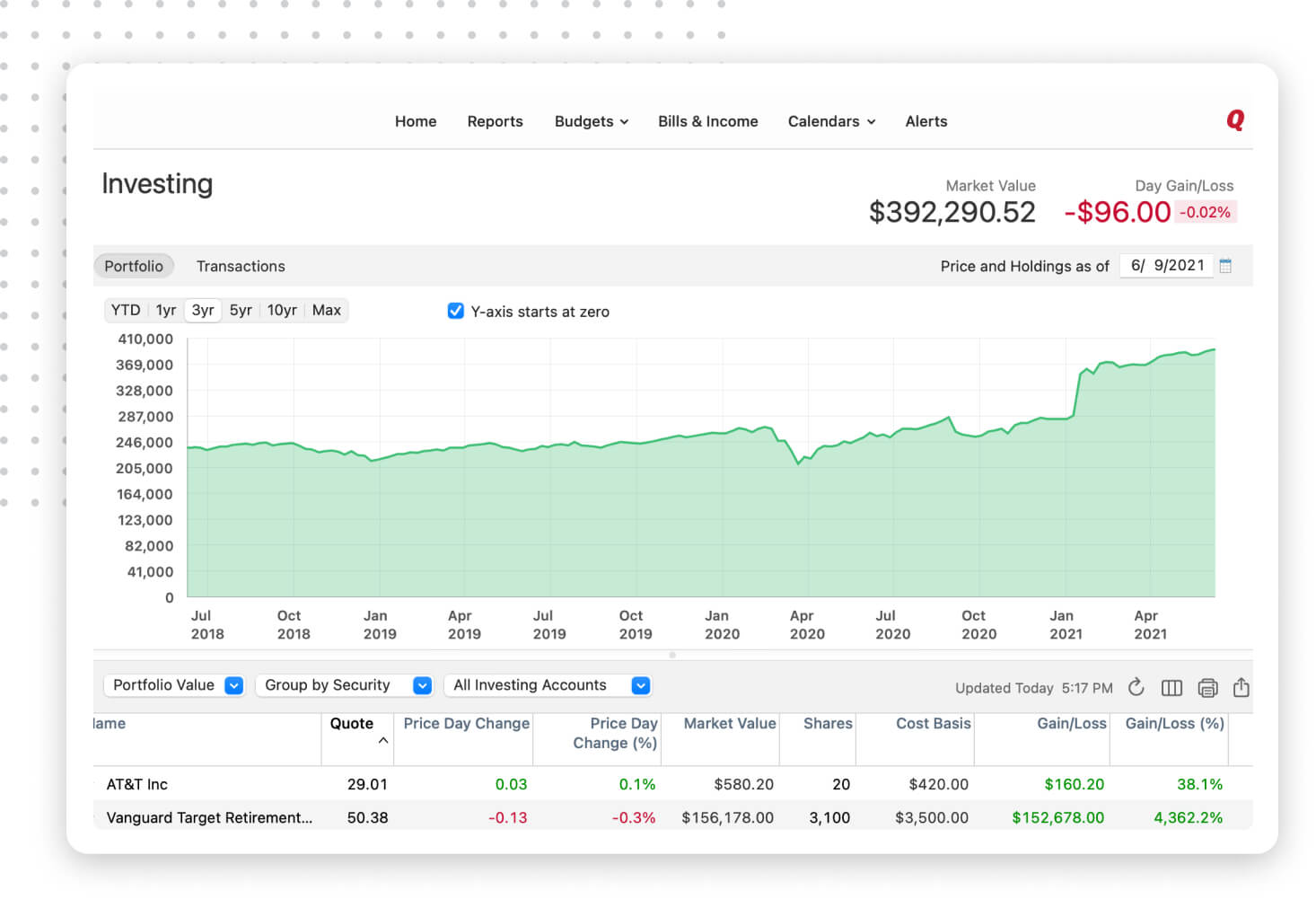

Quicken Retirement Planning Software Plan Your Retirement Today

Best Retirement Planning Tools For 2022 Some Are Even Free

What If A Beneficiary Refuses To Provide Social Security Number For Form K 1 Filing Taxes Turbotax Tax Software

Financial Planning Software By Moneyguidepro Financial Planning Planning Advice Financial Wellness